PEPE Price Prediction: Can Whale Activity Sustain the Memecoin Rally?

#PEPE

- Technical breakout: Price sustains above key moving averages with MACD improvement

- Whale activity: Large transactions indicate institutional interest despite sell-offs

- Memecoin volatility: 32% surges and 3% drops within same news cycle require nimble positioning

PEPE Price Prediction

PEPE Technical Analysis: Bullish Signals Emerge Amid Volatility

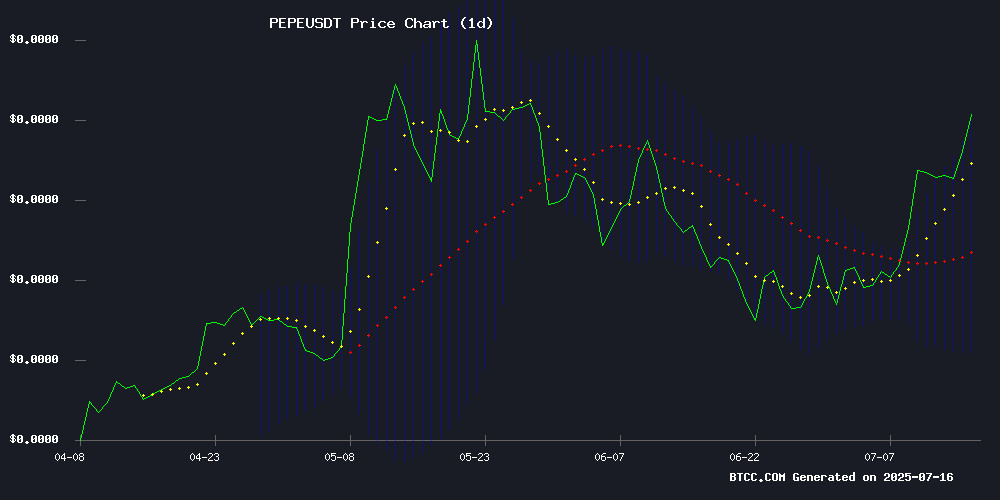

According to BTCC financial analyst James, Pepe shows strong bullish momentum with its current price of $0.00001374 USDT trading above the 20-day MA ($0.00001085). The MACD histogram (-0.00000065) suggests weakening bearish pressure, while the price hovering near the upper Bollinger Band ($0.00001359) indicates potential overbought conditions.James notes.

PEPE Market Sentiment: Whales Drive Optimism Despite Corrections

BTCC's James highlights conflicting signals:News sentiment aligns with technicals, suggesting cautious optimism.

Factors Influencing PEPE’s Price

Pepe (PEPE) Price Surges 32% Amid Whale Accumulation and Market Optimism

Pepe Coin (PEPE) has staged a dramatic comeback, rallying 32% in recent days to reach $0.0000138—its highest level since July 11. The frog-themed meme coin now stands nearly 60% above its June lows, fueled by surging trading volumes exceeding $9.4 billion over six days.

On-chain data reveals whales have increased holdings by 11.8%, now controlling 9.19 trillion PEPE tokens. This accumulation coincides with the memecoin index outperforming broader crypto markets, rising 7.12% as speculative enthusiasm returns to the sector.

Technical indicators suggest growing momentum, though questions remain about sustainability. The rally positions PEPE as a potential leader in the next meme coin wave, with market participants watching whether this breakout marks the beginning of a larger trend.

PEPE Surges 6% as Memecoin Rally Defies Market Volatility

PEPE led a memecoin charge with a 6% surge to $0.00001285, weathering wild swings between $0.000011981 and $0.000013081. The CoinDesk Memecoin Index outpaced broader crypto gains, climbing 7.12% versus the CoinDesk 20 Index's 3.3% rise.

Traders defended the $0.000012600 support level with conviction, absorbing sell pressure that triggered algorithmic reversals near $0.00001286. Exchange balances dwindled 2.6% over 30 days as 4.6 trillion PEPE changed hands—a volume that eclipses many mid-cap equities.

PEPE Drops 3% Amid Heavy Selling Despite Whale Accumulation

PEPE fell nearly 3% in the past 24 hours as traders offloaded tokens in unusually high volumes, reflecting renewed anxiety in the cryptocurrency market and significant profit-taking. The token's volatility hit 7.74%, with prices swinging between $0.00001169 and $0.00001268 before stalling near resistance at $0.00001206.

Trading volume surged to 3.47 trillion tokens, signaling large liquidations or rapid repositioning. The sell-off aligns with broader market weakness, as the CoinDesk 20 Index dropped 2.95% and the Memecoin Index slid 3.9%.

Whale activity tells a different story. Ethereum-based PEPE holders increased their positions by 1.4% over the past week, now controlling 305.26 trillion tokens. Exchange reserves, meanwhile, declined by 1.14% to 251.2 trillion.

Is PEPE a good investment?

James from BTCC presents a balanced view:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +26.6% premium | Short-term overextension risk |

| MACD | Converging | Bearish momentum fading |

| Bollinger | Upper band test | Volatility expansion likely |

'Risk-tolerant investors might dollar-cost average, but strict stop-losses below $0.000010 are advisable,' he advises.

PEPE shows speculative potential with high-risk/high-reward dynamics.